The Dennis Gross net worth story ends with the number every founder dreams about: $450 million. That’s what Shiseido paid to acquire DDG Skincare Holdings in early 2024, making it one of the largest dermatologist-brand acquisitions in beauty history. But the story starts 24 years earlier, in a New York City dermatology office, with a two-step peel pad that would create an entirely new skincare category.

The Alpha Beta Origin Story

Dennis Gross is a board-certified dermatologist and former skin cancer researcher who launched his eponymous brand in 2000 with his wife, Carrie Gross. Their breakthrough product, the Alpha Beta Universal Daily Peel, asked consumers to do something no brand had suggested before: peel their skin every single day.

The concept was counterintuitive. Daily chemical exfoliation sounded aggressive to a market trained on gentle cleansers and moisturizers. However, the two-step peel pads delivered visible results with minimal irritation, converting skeptics into evangelists. The Alpha Beta Peel became the number-one at-home peel in the United States, a position it has held for years.

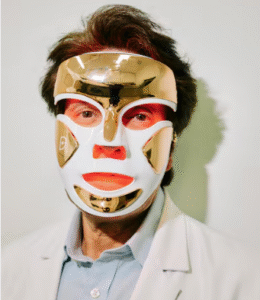

Meanwhile, the DRx SpectraLite FaceWare Pro LED mask became a social media phenomenon, appearing on celebrity Instagram feeds and TikTok videos. The combination of clinical credibility and visual shareability gave the brand a dual-channel growth engine that most competitors lacked.

The Private Equity Bridge

In 2020, private equity firm Main Post Partners invested in Dr. Dennis Gross Skincare. Main Post had previously backed Too Faced and Milk Makeup, giving them deep pattern recognition in prestige beauty exits. Their playbook was clear: professionalize operations, accelerate growth, and position the brand for a strategic acquirer.

The timing proved prescient. By 2023, the “dermatologist-led skincare” category had become one of the hottest segments in beauty, driven by consumer demand for science-backed products over influencer-endorsed hype. Consequently, when Shiseido came looking for a prestige skincare acquisition to strengthen its Americas portfolio, Dr. Dennis Gross was the obvious target.

The $450 Million Exit

Shiseido announced the acquisition in December 2023 and closed the deal in February 2024. The reported price of $450 million represented a premium that reflected both the brand’s growth trajectory and its strategic value to Shiseido’s portfolio.

For Shiseido, the acquisition complemented existing brands like Clé de Peau Beauté and Drunk Elephant while giving them a foothold in the booming dermatologist-led skincare market. Ron Gee, Shiseido Americas’ President and CEO, called it “a natural extension of our commitment to drive the future of beauty and wellness.”

Dr. Dennis Gross retained the title of Chief Science Officer, while Carrie Gross continued as CEO. This structure mirrors the pattern seen in many beauty acquisitions where founders stay on to preserve brand authenticity during the integration period.

What Dennis and Carrie Gross Are Worth

Precise ownership stakes haven’t been publicly disclosed. However, as co-founders who brought in private equity in 2020, the Grosses likely retained a majority stake through the acquisition. Even assuming dilution from the Main Post investment, their combined payout from the $450 million deal would reasonably fall between $150 million and $250 million pre-tax.

In addition to the acquisition proceeds, Dennis Gross maintains his Manhattan dermatology practice, which generates significant revenue from both medical and cosmetic treatments. The combined value of the exit, ongoing compensation from Shiseido, and clinical income places the family’s net worth comfortably in the nine-figure range.

The Playbook for Dermatologist Brands

The Dr. Dennis Gross acquisition is a case study in the MD-to-DTC pipeline that’s reshaping beauty. The formula is increasingly replicable: build clinical credibility through a medical practice, launch a hero product that solves a real problem, grow through specialty retail and social media, take PE money to scale, and exit to a strategic acquirer.

Moreover, the $450 million price tag set a benchmark for the entire dermatologist-brand category. It told every board-certified dermatologist with an Instagram following and a signature product that the ceiling was much higher than anyone had imagined.

For comparison with a peer who has taken a different path, see our analysis of Dr. Barbara Sturm’s independent empire. And for the broader market dynamics driving these valuations, explore our medspa industry economics and wellness brand acquisitions guide.